CA Relief Grant FAQs

Many CA Relief Grant applicants have been contacting the LA SBDC with questions about their application. We don’t have access to the backend of Lendistry’s application website, but we are doing our best to compile information about the grant application every day.

Below are the frequently asked questions we have researched. We have done our best to ensure accuracy in our guidance, but be aware that all technical requirements and procedures are set by Lendistry and are subject to change without notice.

Also, please view this webinar recording from earlier today. The first 10 minutes answers the most common problems.

While we do not have the staffing to respond to each inquiry individually, we hope this FAQ will answer many of your questions.

You can find additional information on our CA Relief Grant info page.

Guide to the CA Grant Website

Official CA Grant homepage: https://careliefgrant.com

- An overview of the grant application process

Official Frequently Asked Questions (FAQ): https://careliefgrant.com/faq/

- Answers to many additional questions not addressed here

The Certification Document PDF

Frequently Reported Technical Issues

I’m concerned I’m not going to be able to submit my application by the deadline.

Do your best to complete step one of the application (the 6 sections before the document upload). We’re told that Lendistry will still consider your appplication even if you are unable to upload the documents by the deadline. You will have an opportunity to upload documents at a later time when the Lendistry site is working better.

Also, note that this is Round 2.

We have identified solutions to several common problems, which are detailed below. We (the SBDC) have no access to the website backend and are not able to check application status or confirm that it was received.

However, if you have a non-technical problem, e.g. “how do I calculate my Q2-Q3 income?” or “what type of tax documentation do I need to provide?”, the SBDC can help. Call your nearest SBDC center to get help with non-technical questions.

I can’t upload my documents.

-or-

I uploaded my documents but now some are missing.

-or-

I received an email asking me to upload documents even though I already did.

Try the following:

- If you have already started the application process and now cannot upload documents or get back into the system, Lendistry is requesting that you try getting into the system with your password one more time. Use the link in the email sent by Lendistry instead of going to the grant website directly to log in.

- Refresh your grant page before uploading. If the page was open for a long time and wasn’t connected to the server anymore, it may appear that items are uploaded until you try to go to the next step. Refresh and try again.

- Be sure to enter your password after each upload, if requested. Only some people’s applications are requiring this. It’s the same password you used to access your application.

- All documents should be PDFs.

- All documents should be less than 15 MB in size. You can compress (zip) them or split them into multiple files if needed. Note: The compression method works best.

- Please do not email your documents to us. We do not have access to the website to upload them.

- When you finish uploading your documents, there is no submit button and you will not receive a confirmation email. Lendistry is telling us that you WILL have a chance to upload your documents after the 13th if something goes wrong with your uploads.

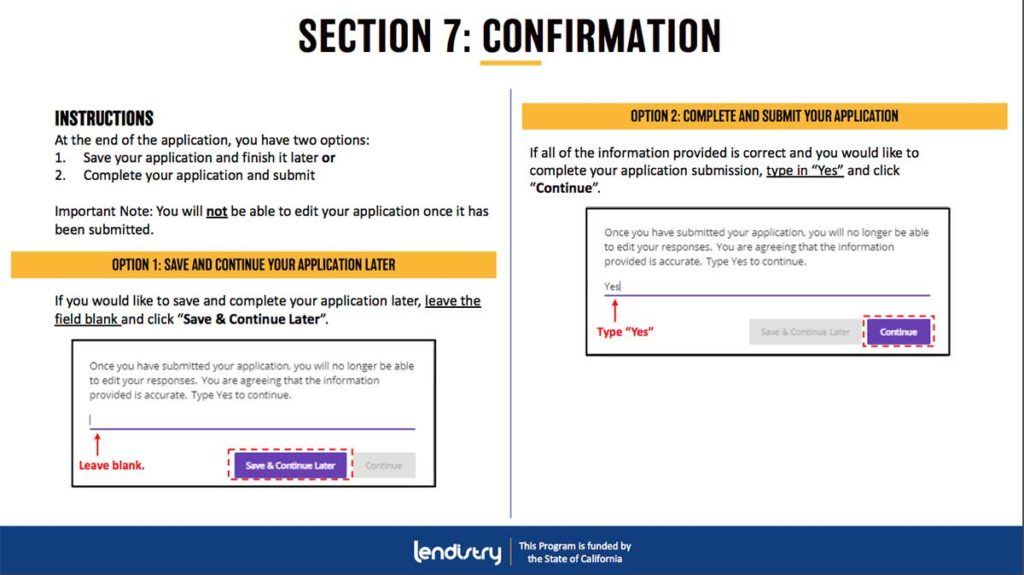

- If you have completed Step 1 (filling out all the blanks in the application), but you can’t upload any documents at all, be sure you have typed “Yes” in the blank and clicked “Continue.” (see Section 7: Confirmation image below for a visual).

- If you do not see this screen, be sure you are able to view pop-ups. You may need to disable your pop-up blocker.

I finished uploading documents, but my application still says “Pending” or “Pending Document Uploads.”

Some clients who have completed their applications and uploaded documents are reporting that the system still says “pending.” This may be because the banking information has not been completed.

You DO NOT need to submit banking documents unless you are selected to receive a grant. Therefore, you may still see “Pending” after your application is successfully completed.

I can’t finish providing bank info and linking to my bank account.

You don’t need to upload the bank information until after you are approved for the grant. In the meantime, if it’s not letting you proceed, you can put all zeros in the bank account number field.

If you have a message that says “Pending” but you finished uploading the other documents, then you should be done.

I’m afraid I’ve been hacked or scammed.

The CA Relief Grant application has no fee. If you are asked to pay a fee, you are being scammed. Please apply through careliefgrant.com only.

If you are concerned about providing bank information, please not it is not required until you are notified that you have been approved for the grant.

Do I have to give my mobile number?

You do not have to include your cell phone number in the application, but we strongly recommend that you do. Texting is an additional way Lendistry can contact you about your application status.

Some clients have noted that emails from Lendistry are going to their spam (or junk) folders. So, providing Lendistry your phone number is giving them an alternate method to contact you.

It is also recommended to put Lendistry in your Safe Senders list in your email account.

How do I complete the Application Certification?

This is covered on the CA Relief Grant Website. Please take a look at Tip #5 here.

I need to change something I entered in my application.

If you have EDITS that need to be made to an application that has previously been submitted, please email careliefgrant@lendistry.com with the subject line “FINISHED APPLICATION EDIT REQUEST.”

Please list the items that need to be updated. A confirmation email will be sent to you.

I haven’t received a return call from Lendistry.

Lendistry is experiencing an extremely high call volume. They recommend leaving a message. When Lendistry returns your call, it may appear as “potential spam” on your Caller ID.

Lendistry will help reset passwords, help upload documents, and can assist with any issues or password protected items.

I haven’t received a follow-up email from Lendistry.

Many clients are reporting that they haven’t received any follow-up emails from Lendistry after starting their applications. Lendistry will be sending an email with your password in order to complete the rest of the application and then upload the required documentation. Some tips:

- Please check your junk mail and spam.

- Add Lendistry to your “Safe Senders” list.

I haven’t received a reply to an email I sent to Lendistry.

- Don’t reply to a Lendistry email if the email address is no-reply@lendistry.com. Instead, email CAReliefGrant@lendistry.com if you have questions.

- If you have a grant ID#, put it in the subject line.

I walked away from my computer and the application automatically submitted itself before I finished it.

This is happening to many people who have paused or left the computer in the middle of the application. Sometimes it even happens while you are filling out the application.

You should have received an email from Lendistry explaining how to complete it, and it will contain a link to return to your account. These emails are sometimes taking 24-48 hours to arrive.

Some people are having ongoing issues with this or have not received an email from Lendistry. Please contact Lendistry for assistance with this issue.

Application Content Issues

How do I calculate my revenue for 2020 since I haven’t done my taxes yet? How do I calculate Q2-Q3 revenue?

If you have Quickbooks or another bookkeeping software program, you can output a report for the relevant months in 2020.

If you haven’t done your 2020 bookkeeping yet or don’t know how to do this, you can use your bank statements to estimate the revenue by summing up all the deposits to your business bank account during the days between April 1 and Sept 30.

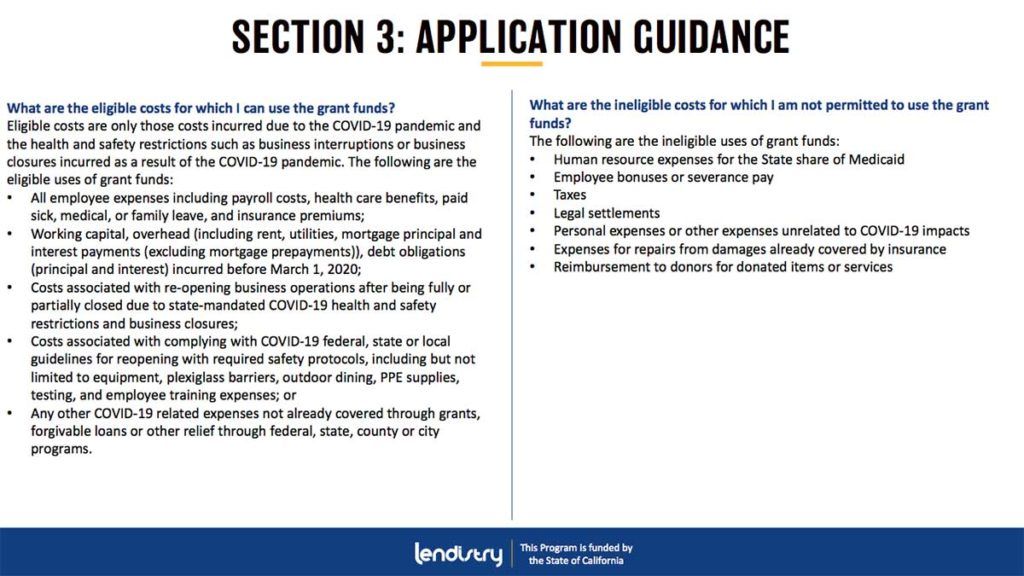

What should I say I am going to spend the grant on?

Click here to see page 64 of this document for a list of eligible expenses:

There’s also some discussion in the SBDC’s Jan 8 Q&A webinar, click here to view the recorded webinar.

You can just write one major expense for your business.

You can pay for payroll even if you got the PPP, but you have to use the grant for a different time period than the PPP so that you aren’t double-dipping.

There are some expenses, (for example, some types of taxes), that you can’t pay for with the grant.

Be sure to keep receipts for what you spend the grant on for three (3) years.

I’m a sole proprietor. I don’t have Articles of Incorporation

Sole proprietors and 1099 contractors don’t use Articles of Incorporation.

If you’re in a geographic region where a business license is required from the city or county, you can upload that. Or if you have a DBA for your sole proprietorship, you can use that. Or if you don’t use those two, check “N/A”.

If you live in Los Angeles, your business license says “Tax Registration Certificate” and has a drawing of City Hall in green. You receive it in the mail after paying your city tax due in February each year.

Which tax forms should I upload?

You may have heard earlier that some businesses don’t need to upload all their tax forms and attachments. However, we now understand that you must upload all the pages, even if it’s a lot of pages.

If the file is more than 15 MB, you will need to split the pages into several files, each less than 15 MB, and upload each file individually. Or compress (zip) the files.

I have questions about the number of employees and jobs created.

The following questions on the application are for large-scale data gathering only. They do not affect your eligibility for the grant, so just answer them in a way that seems reasonable to you:

- Will this grant create new jobs?

- # of full time employees

- # of part time employees

- # of jobs created

- # of jobs retained

Do I want a loan?

The question on whether you want a loan will just inform the organization helping you with the application (i.e. us, the SBDC) so we can reach out to coach you through the process of applying.

It is not considered in the scoring of the grant, so you can choose either answer.

I started my business after June 1, 2019, but I have been affected by COVID.

Unfortunately, you need to have been in business as of June 1, 2019 in order to be eligible for the CA Relief Grant. Please contact the SBDC if you would like to explore other financial support for your business.

In the section “Have you received other grants?” there are loans.

-or-

I got the PPP but it hasn’t been forgiven yet. Is it a grant?

–or-

There is more than one item in the grant list that I have received [e.g. PPP and EIDL] but it only lets me choose one.

–or-

Should I sum up only the grants on this list, or all grants I have received?

More accurately, the question should read: “Have you received other grants and loans?”

If you received more than one, choose “Other” and write all the COVID-related financial support you have received in the blank. And then total all the aid (loans and grants) you have received from any source and put that in the blank.

The application certification says I can’t take this grant if I have taken another grant. Am I ineligible?

Don’t worry! Section 9 of the application certification is referring to taking more than one CA Covid Relief Grant. It’s okay if you have won other grants. You can still apply for this one.

- You can’t apply twice for the CA Covid Relief Grant for the same business.

- And you can’t apply twice for two businesses you own. (Choose the highest earning one.)

I have a business with multiple owners

-or

I have multiple businesses with multiple owners

A business should not take more than one grant.

An individual who owns more than one business should not take a grant for both businesses. The owner (51% or more) must choose only one business. It must be the business with the highest top-line revenue in the year of the most recent tax return (2018 or 2019).

Example:

Person A owns 70% of Business 1 and 30% of Business 2. Person B owns 60% of Business 2. Person C owns 10% of Business 2. So Person A applies for the grant for Business 1 and Person B for Business 2. Person C does not apply for a grant.

Here’s the plain language version from careliefgrant.com:

“Owners of multiple businesses, franchises, locations, etc. will be considered for only one grant and are required to apply for the business with the highest revenue.”

See item 9 in the for-profit certification document for the exact rule.

Non-Profit Specific Questions

How do I fill out the section for non-profit “owner”?

For a non-profit, you will need to put the personal info (home address, individual SSN, etc.) for either the executive director or the chair of the board.

The designated person’s credit will not be affected by this application. For the ownership, put 0%.

Non-profit demographics

This question is about your staff. It doesn’t specify whether to calculate the percentage by number of employees, work hours, etc.

From the certification document, section 11:

. . . for the purposes of establishing status as underserved for a grant under the Program, then, in each case, at least 51% of the Applicant’s organization must be run on a daily basis by such persons to satisfy such priority requirements.

Known Issues

We have not received a solution from Lendistry about these issues:

- A few people have seen their application switch to a different grant amount or even switch to $0.

- A few for-profit applicants log back in to finish an incomplete application and “non-profit” is the only option available for “business type.”

We encourage you to contact Lendistry for help with these issues.

Contact Lendistry

- Call Center: 888.612.4370

- Email: CAReliefGrant@lendistry.com

Lendistry Customer Service hours have been extended:

- Tuesday – Friday 7:00 AM – 11:00 PM PST

- Saturday: 7 AM – 12 PM PST