The LA SBDC Network offers no-cost virtual business workshops for small businesses in Los Angeles, Santa Barbara, and Ventura Counties.

Events Search and Views Navigation

May 2021

WEBINAR Angel Investment 101 for Start-Ups

Funding and financing your business are extremely important. One of the options that comes up is angel investment. What does angel investment mean? How often does it happen? Is your business a candidate? What steps to take? What do you need? Webinar presenter Tim Berry has been on both sides of this table. He successfully raised investment for his business. And he has been an angel investor for more than a decade. In this webinar, Tim answers…

Find out more »WEBINAR Financing Your Business

This class will teach what you need to know to apply for a business loan. Topics include: What documents and paperwork you will need to use for the application process from major banks, which banks are currently loaning money and what you will need to qualify, why a business may need financing, sources of credit, and what you should know about credit. Instructor: Larry Johnson REGISTER NOW

Find out more »Commercial Real Estate Loans for Small Business Webinar

In this Webinar we will cover: • Lending resources • SBA loan programs • Qualifications and requirements • SBA loan application process • Do’s and Dont’s when financing your business REGISTER NOW

Find out more »July 2021

WEBINAR Financing Your Business

This class will teach what you need to know to apply for a business loan. Topics include: What documents and paperwork you will need to use for the application process from major banks, which banks are currently loaning money and what you will need to qualify, why a business may need financing, sources of credit, and what you should know about credit. Instructor: Larry Johnson REGISTER NOW

Find out more »August 2021

Access to Capital Webinar

For many small business owners, understanding the role debt plays in the business readiness process isn’t so clear. This workshop will help entrepreneurs and small business owners bring finance into focus for long term success. Topics for discussion will include: • Common ways to fund a business • Financing options available to small businesses • Loan readiness and how you can prepare for funding • Real-world examples of how to leverage financing programs. Presented by: Spencer Rich REGISTER NOW *The…

Find out more »WEBINAR SERIES- Crowdfunding the Newest Way For Startups and Entrepreneurs to Raise Capital

Series Overview: In the past, when someone wanted to fund something — be it a project, a company, or anything that required capital to start — there were a few ways to raise money. They could take on debt from a loan. They could raise money from friends, family members, and angel or VC investors. They could even take the “bootstrapping” route and scrounge up as much money as possible to fund the project themselves. In the late 2000s, a fourth…

Find out more »PPP Forgiveness – Update on PPP Flexibility Act

The objective of this webinar is to help you understand how to calculate the forgivable amount of your PPP Loan and to prepare documentation that may be required with your forgiveness application. REGISTER NOW

Find out more »Access to Capital Webinar

For many small business owners, understanding the role debt plays in the business readiness process isn’t so clear. This workshop will help entrepreneurs and small business owners bring finance into focus for long term success. Topics for discussion will include: • Common ways to fund a business • Financing options available to small businesses • Loan readiness and how you can prepare for funding • Real-world examples of how to leverage financing programs. Presented by: Spencer Rich REGISTER NOW *The…

Find out more »February 2022

Webinar – Veterans, Military and Spouses Series: Finding Funding

Explore a variety of funding types for your business. Capital is critical for all businesses. The type of business, your capital needs, and additional factors may influence what you explore. There are many types of capital including owner investment, profit reinvestment, loans from a bank, loans from an alternative financial resources(non-banks), equipment financing, tax credits, supplier credit, credit lines, equity lines, Angel Investors, Venture Capital Investors, money invested by family & friends, Crowd Funding, etc. REGISTER NOW

Find out more »April 2022

Webinar – Finding Funding

Explore a variety of funding types for your business including disaster assistance related. Capital is critical for all businesses. The type of business, your capital needs, and additional factors may influence what you explore, along with the current climate. There are many types of capital including owner investment, profit reinvestment, loans from a bank, loans from an alternative financial resources(non-banks), equipment financing, tax credits, supplier credit, credit lines, equity lines, Angel Investors, Venture Capital Investors, money invested by family & friends, Crowd Funding,…

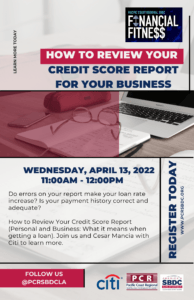

Find out more »Special Event – How to Review Your Credit Score Report with CitiBank

Special Event: How to Review Your Credit Score Report (Personal and Business: What it means when getting a loan) with CitiBank. Do you know how credit affects your access to capital? Do errors on your report make your credit loan increase? Is your payment history correct and up to adequate? Join us with our partner Cesar Mancia to discuss how to review your credit score report. REGISTER NOW

Find out more »WEBINAR Money Matters: How to Finance Your Business

This workshop will provide an overview of available options for financing your business. Equity and debt options as well as crowdfunding and the process for raising capital from friends and family will be discussed. Details on what you need to know to apply for a business loan, as well the required documents and paperwork needed for the application process will be provided. The various types of financial institutions and which institutions are currently loaning money and what you will need…

Find out more »Webinar – Veterans, Military and Spouses Series: Finding Funding

Explore a variety of funding types for your business. Capital is critical for all businesses. The type of business, your capital needs, and additional factors may influence what you explore. There are many types of capital including owner investment, profit reinvestment, loans from a bank, loans from an alternative financial resources(non-banks), equipment financing, tax credits, supplier credit, credit lines, equity lines, Angel Investors, Venture Capital Investors, money invested by family & friends, Crowd Funding, etc. REGISTER NOW

Find out more »May 2022

WEBINAR Money Matters: Angel Investment 101 for Start-Ups

Funding and financing your business are extremely important. One of the options that comes up is angel investment. What does angel investment mean? How often does it happen? Is your business a candidate? What steps to take? What do you need? In this webinar, Tim answers key questions you may have about angel investment for your business. Including: Reality check: common myths about angel investment and the realities behind them. What is angel investment? How is it different from friends…

Find out more »WEBINAR Money Matters: How to Finance Your Business

This workshop will provide an overview of available options for financing your business. Equity and debt options as well as crowdfunding and the process for raising capital from friends and family will be discussed. Details on what you need to know to apply for a business loan, as well the required documents and paperwork needed for the application process will be provided. The various types of financial institutions and which institutions are currently loaning money and what you will need to…

Find out more »Special Event – Types of Loans with Citi

Special Event: Types of Loans with CitiBank Do you know the different types of loans? Do you understand how the type of loan you apply for effect your business? Join us with our partner Cesar Mancia to discuss the types of loans available to small business owners. REGISTER NOW

Find out more »September 2022

Webinar – Finding Funding

Explore a variety of funding types for your business including disaster assistance related. Capital is critical for all businesses. The type of business, your capital needs, and additional factors may influence what you explore, along with the current climate. There are many types of capital including owner investment, profit reinvestment, loans from a bank, loans from an alternative financial resources(non-banks), equipment financing, tax credits, supplier credit, credit lines, equity lines, Angel Investors, Venture Capital Investors, money invested by family & friends, Crowd…

Find out more »WEBINAR Money Matters: Angel Investment 101 for Start-Ups

Funding and financing your business are extremely important. One of the options that comes up is angel investment. What does angel investment mean? How often does it happen? Is your business a candidate? What steps to take? What do you need? In this webinar, Tim answers key questions you may have about angel investment for your business. Including: • Reality check: common myths about angel investment and the realities behind them. •What is angel investment? How is it different from…

Find out more »WEBINAR Money Matters: How to Finance Your Business

This workshop will provide an overview of available options for financing your business. Equity and debt options as well as crowd funding and the process for raising capital from friends and family will be discussed. Details on what you need to know to apply for a business loan, as well the required documents and paperwork needed for the application process will be provided. The various types of financial institutions and which institutions are currently loaning money and what you will…

Find out more »October 2022

WEBINAR Money Matters: How to Finance Your Business

This workshop will provide an overview of available options for financing your business. Equity and debt options as well as crowdfunding and the process for raising capital from friends and family will be discussed. Details on what you need to know to apply for a business loan, as well the required documents and paperwork needed for the application process will be provided. The various types of financial institutions and which institutions are currently loaning money and what you will need…

Find out more »How To Be Bankable

If you are looking to make your business bankable this webinar is for you! We know that finances can be scary but with the right help it can be the new best friend of your business. Join us as we look at what’s needs to make sure you are bankable and ready to grow your business when applying for a loan. REGISTER NOW

Find out more »November 2022

WEBINAR Money Matters: Angel Investment 101 for Start-Ups

Funding and financing your business are extremely important. One of the options that comes up is angel investment. What does angel investment mean? How often does it happen? Is your business a candidate? What steps to take? What do you need? Webinar presenter Tim Berry has been on both sides of this table. He successfully raised investment for his business. And he has been an angel investor for more than a decade. In this webinar, Tim answers key questions…

Find out more »WEBINAR Money Matters: How to Finance Your Business

This workshop will provide an overview of available options for financing your business. Equity and debt options as well as crowdfunding and the process for raising capital from friends and family will be discussed. Details on what you need to know to apply for a business loan, as well the required documents and paperwork needed for the application process will be provided. The various types of financial institutions and which institutions are currently loaning money and what you will need…

Find out more »Webinar: Culver City Chamber of Commerce- Let’s Get Funded

Money doesn’t grow on trees. But COVID changed that notion albeit temporarily. Since the beginning of the pandemic along with the EIDL program–the government disbursed a whopping $1.27 trillion in COVID-related relief to small businesses. Due to a convergence of increased consumer demand, the war in Ukraine, ongoing supply shortages, high gas prices and huge influx of government money into our economy–we have the highest inflation levels since 1981. What’s that mean for you? Unlike during the pandemic, there is NO more free or subsidized government money.…

Find out more »Webinar – Finding Funding

Explore a variety of funding types for your business including disaster assistance related. Capital is critical for all businesses. The type of business, your capital needs, and additional factors may influence what you explore, along with the current climate. There are many types of capital including owner investment, profit reinvestment, loans from a bank, loans from an alternative financial resources(non-banks), equipment financing, tax credits, supplier credit, credit lines, equity lines, Angel Investors, Venture Capital Investors, money invested by family & friends, Crowd…

Find out more »