The LA SBDC Network offers no-cost virtual business workshops for small businesses in Los Angeles, Santa Barbara, and Ventura Counties.

Events Search and Views Navigation

October 2024

Should You Be Charging Sales Tax – What You Need to Know!

Should you charge sales tax? What if you are selling out of state or on an online platform? These are the type of questions that many business owners are asking. Addressing sales tax requirements has been even more confusing. On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states can mandate that businesses without a physical presence in a state with more than 200 transactions or $100,000 in-state sales collect and remit…

Find out more »SmallBiz Talk: Solutions for Your Small Business

This is SmallBiz Talk with small business expert and LA SBDC business advisor Lori Williams. Join her as she covers key business topics through instructional information, real life situations, guest speakers and interviews. At the end of the show, participants can engage in a Live Q&A with questions pertaining to their specific business situation. Join us live every Wednesday at 10 a.m. or check out our YouTube Playlist to see previous shows and to gain information/ helpful insights for your…

Find out more »November 2024

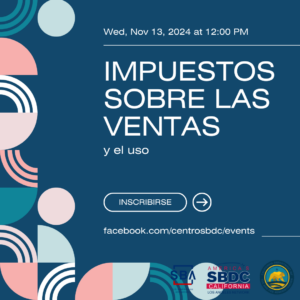

Impuestos sobre las ventas y el uso

Clase de impuestos de ventas para que aprendaz tus responsibilidades como empresario en el estado de California. Temas incluyidos cubriran terminus legales, de contaduria, cumplimento fiscal y deducciones comunes bajo la ley de impuestos. Requisitos para vendedores en virtud de la Ley del impuesto sobre las ventas y el uso Tipos de transacciones que están sujetas al impuesto Uso de certificados de reventa Deducciones y exenciones comunes Acceso a recursos y servicios del CDTFA REGISTER NOW

Find out more »